INSMAN – Insurance Management

INSMAN – Insurance Management

Insurance Management & Claims System

INSMAN is designed for captives and self-insured companies to take control of their entire insurance management process. Since the turn of the millennium, it has become the dominant insurance system in the segment for captives and self-insured companies. Clients are found in various industries, including manufacturing, energy, pharmaceuticals, and the public sector.

All parts of the process are handled in integrated workflows: insurance with a renewal process, invoicing, claims management, surveys & inspections, and reporting support. Everything is consolidated in a modern, web-based system.

Integrated Collaboration

Involve colleagues and invite external parties directly into the system. Avoid redundant systems and non-integrated reporting that are outside of your control. Allow local administrators to be responsible for updating insurance values. Share selected information with reinsurers and brokers.

Through strict access control, surveyors and claims administrators can register information such as claims data, EML, insurance values, or new inspections directly in the system.

Efficient Analysis

Use the Report Generator to create submission materials, and generate reports for insured object values, claims statistics, company and user information, etc.

Regulatory reporting like Solvency II has its own process for data extraction, validation, and potential integration with reporting tools.

Analysis of system data is easily done in integrated dashboards. With just a few clicks, the information can be viewed and analyzed from different perspectives. Graphical elements like pie charts, heatmaps, and gauges provide an easy-to-interpret overview. Suitable for both daily work and the boardroom!

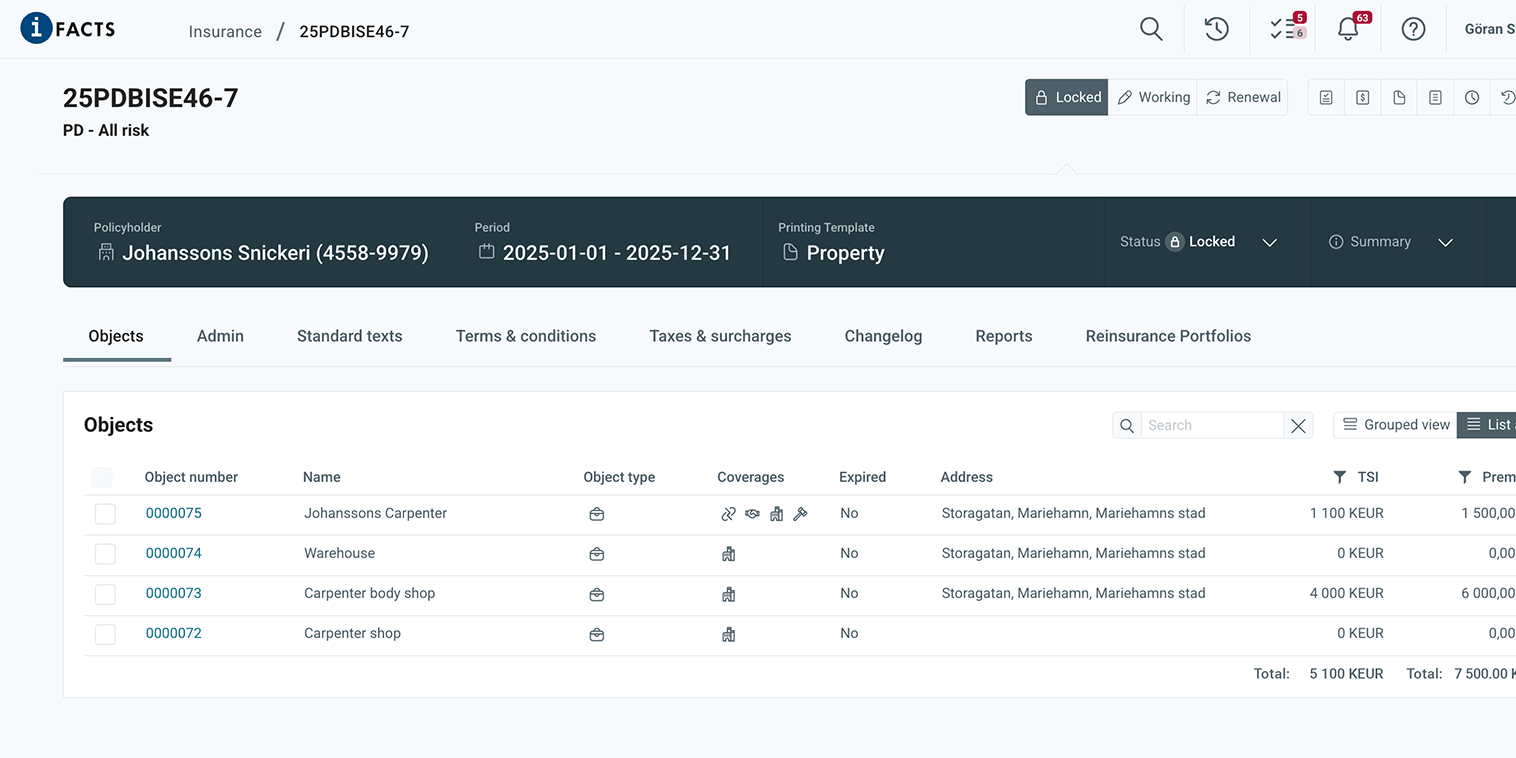

Insurance Management

Insurance management is flexible and allows the administrator to set up insurance types. It is easy for the administrator to adapt content and processes depending on the insurance type and scope. The system handles both direct insurance and received reinsurance.

Registered information is used to generate insurance policies based on individual templates. Built-in version control of the insurance policies ensures that the current policy is always available and that claims are linked to the correct version.

Information from the insurance policy can easily be reused in other contexts, for example, as support for EML/PML calculations in loss prevention work.

Premium allocation is done via an efficient simulation tool, providing a superb overview and traceability for fine-tuning technical rates, adjustments, and premiums. Once rates and premiums have been accepted, they are moved from the simulation environment to the production environment with a single click.

The Renewal Process

Support for the entire insurance renewal process, from the selection of insurance types and policyholders to the issuance of new policies. The "Boomerang" tool can be used as part of the process for effective communication with policyholders and other stakeholders.

Indexing and premium modeling are functions that facilitate value management and premium allocation in the renewal process.

Reinsurance

By registering reinsurance portfolios per UW (Underwriting) year, the system calculates the reinsurers' share of claims. This information is used both for internal accounting and for follow-up with reinsurers in the form of a Statement of Account report.

Claims on reinsurers can be automatically converted into cash calls in the invoicing module.

Via the Reinsurer Portal, external parties such as brokers and reinsurers can continuously access current insurance information, inspections, claims, terms and conditions, etc.

Benefits

INSMAN gives captives and self-insured companies full control over the entire insurance process – from renewal and claims management to reinsurance and reporting.

The system consolidates everything into a modern interface with flexible workflows, secure access control, and seamless collaboration with external parties.

With powerful analysis and visualizations, complex data becomes simple and valuable – both operationally and strategically.

Workflows

- Insurance management with value management, premium calculation, and taxes

- Premium modeling allows for the allocation of premiums with traceability

- Invoicing is fully integrated with the insurance management system

- Renewal management keeps the renewal process structured and organized

- Reports and dashboard

Contact

Göran Svensson

Phone: +46 73 524 12 52

Email: goran.svensson@ifacts.se

Case

SKF Supports the Entire Insurance Process

”One system supporting all our insurance needs in one complete process”

Essity Insurance, Claims & Loss Prevention

“Using our own system gives us the power over the information.”

E-services at SKFAB with Automated Case Management

The new e-services at SKFAB (Svenska Kommun Försäkrings AB) are built on a solution from iFACTS AB for claims registration and for private individuals to supplement their case information. It is a seamless and secure solution, fully integrated with the established INSMAN insurance and claims management system. SKFAB has implemented the solution for all of […]